Unless you begin to use Sage 50 Accounting when you start your business, you will need to know your account balances as of the date you start working with and recording transactions in Sage 50 Accounting.

- Determine your company’s Fiscal Start date. This will be the earliest date on which you can record transactions for your company.

- Prepare a Trial Balance Report as of your fiscal start date.

- Gather together all outstanding customer invoices, and all unpaid supplier bills.

- Make a list of the items you sell, including their selling prices.

Note: If you've been in business for a while, you will need to refer to this report to update Sage 50 Accounting after you create your company. The Trial Balance lists all your account balances as of a given date. Ask your accountant for this report as of the conversion date you choose.

If you are converting from another computerized accounting system such as QuickBooks, you should be able to print the report yourself. So, if you convert to Sage 50 Accounting on January 1, 2018, you will need the trial balance report as of December 31, 2017.

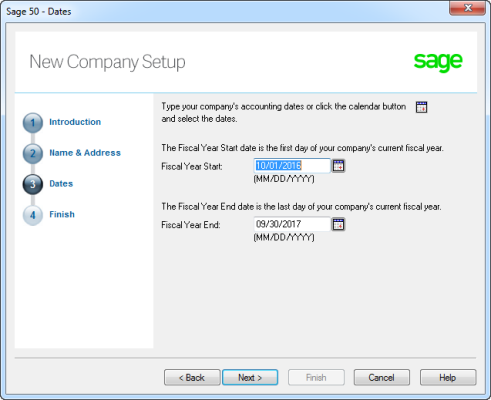

The New Company Setup Wizard guides you through the process of creating a new company in a few simple steps.

- Enter your company name and address information.

- Enter your fiscal year Start and End dates.

- Click Finish, and Sage 50 Accounting will create your company.

Now that you have set up your company, you are ready to review your company settings and get your books up to date.

In Sage 50 Accounting, settings are divided into the following types:

- System settings

- User preferences

- Form and report settings

You'll find system settings in the Settings window, grouped by module. Backup options and settings that affect more than one module are located within the Company group.

It is important to review the Sales Taxes system settings for your company to ensure that you are charging and being charged the correct amounts.

Tip:

Report options define the default print settings for reports.

Select the form type for the business forms you use, such as cheques and invoices.

Set up Sage 50 Accounting to remind you when to order new cheques.

The New Company Setup Wizard creates a set of accounts for your business.

Sage 50 Accounting creates four main cash/bank accounts for you to use:

- Cash Draws

- Chequing Bank Account

- Petty Cash

- Savings Bank Account

You can create additional bank accounts if you need them for your business.

If you've been running your business for a while, you already have balances to add to your accounts.

- Refer to your most recent Trial Balance report—the same one you used when you created your company.

- On the Tools menu, select For My Accountant and then Account Information.

- Open each account and then enter the account balance from the trial balance. If you start entering transactions in Sage 50 Accounting as of your fiscal start date, your trial balance will be quite simple—it will contain balances for only your balance sheet accounts, not income and expense accounts.

- Click Save and Close to save your changes.

To ensure that you have entered your accounts and balances correctly, print a trial balance in Sage 50 Accounting and check it against your existing records.

- In the Home window, open the Report Centre. Select Financials, Trial Balance, and then Opening Balances.

- Click Display to view the report.

- To print the report, ensure that your printer is set up, and then choose Print from the File menu or toolbar.

- Compare the account names and balances against your existing records.